E/M Changes Are Here—What Health Lawyers Need to Know about the Compliance and Reimbursement Impacts

This Briefing is brought to you by AHLA’s Enterprise Risk Management Task Force.

- October 19, 2020

- Rob Stone , Alston & Bird LLP

- Valerie G. Rock , PYA, PC

Health care attorneys who address physician billing compliance and compensation issues will need to be well-versed in the 2021 Evaluation and Management (E/M) changes and the subsequent reimbursement impact they will have on the 2021 Medicare Physician Fee Schedule (MPFS). This article examines the reimbursement impact and the likely areas of contention as audits on compliance with the new guidelines begin. It also analyzes potential implications on fair market value due to changes in what has become an extremely common approach to physician compensation—the work relative value unit (wRVU) incentive compensation model.

Background

The Centers for Medicare & Medicaid Services’ (CMS’) initial push for a change to the interpretation for E/M codes was in the proposed and final rule for calendar year (CY) 2018. Based on its communication with stakeholders, CMS took the position that history and exam requirements were outdated and that medical decision-making (MDM) and time were more appropriate for E/M level selection.

“As long as a history and physical exam are documented and generally consistent with complexity of MDM, we believed there may no longer be a need for us to maintain such detailed specifications for what must be performed and documented for the history and physical exam (for example, which and how many body systems are involved).”[1]

CMS encouraged the American Medical Association (AMA), which owns and publishes the Current Procedural Terminology (CPT®) codes and descriptions, to consider the descriptions and guidelines for these codes, especially due to CMS’ proposals in 2019 through MPFS rulemaking to flatten the reimbursement of the Level 2 through 4 E/M codes. The AMA created a work group representing the CPT Editorial Panel to develop new guidelines. Additionally, the AMA/Specialty Society RVS[2] Update Committee, known as the RUC, completed new surveys for E/M services. The RUC uses medical society surveys to determine the appropriate physician work value for proposal to CMS as a wRVU. The wRVUs account for the time, technical skill, physical effort, mental effort, judgment, and stress involved in providing a service.

The CPT work group and the RUC started with the Office and Other Outpatient Services E/M Codes (99201 – 99215) in their coding and work valuation assessments. As a result, the 2021 changes are only for this range of codes. The CPT work group produced a new set of guidelines for this code range,[3] and the RUC proposed updated wRVUs to CMS in the fall of 2019. CMS adopted the new CPT guidelines in the CY2020 Final Rule, where they also finalized the updated wRVUs amounts.

While CMS initiated these changes, the new guidelines and new definitions of the E/M codes will be incorporated in the CPT manual, making the coding changes industry-wide.

Reimbursement Impact

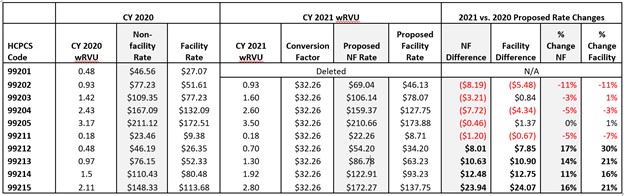

CMS changes must be budget neutral. Due to the significant increase in value of the E/M office codes, substantial incremental dollars will be directed to E/M reimbursement. To offset this increase, CMS was required to include an overall adjustment to comply with the statutory limitation to annual increases or decreases based on changes in the codes or their values (+/-$20 million). Therefore, the fee schedule proposes a 10.6% decrease in the Conversion Factor (CF) that is multiplied by applicable RVUs, resulting in a dollar value. The changes will impact Medicare reimbursement as well as the reimbursement from those payer contracts that utilize the “current” MPFS as a basis for their reimbursement methodologies. The below chart, which utilizes the 2020 and proposed 2021 RVUs and CF published by CMS, indicates the wRVU increases in 2021, as well as the financial implications of the proposed fee schedule changes. Large swings in reimbursement, both positive and negative depending on the specialty, have the potential to significantly impact health care revenues.

The shift in Medicare collections will be based on utilization. Practices whose primary volume is rooted in the established patient visit E/M codes (99212 – 99215) will see the most significant increase in Medicare revenue. However, the fee schedule’s negative adjustment to the remainder of the CPT and HCPCS codes will have a negative impact on reimbursement for practices whose revenue is rooted in procedural services, such as surgical specialties.

Coding Impact (Overview of E/M Changes)

As the CPT work group revised the guidelines for the Office and Other Outpatient Services codes, it found that 99201, the lowest level of new patient code, was no longer relevant, so it was deleted. As a result, the relevant code range for these changes will be 99202 through 99215. This includes the new patient and established patient visits. This change does not include other E/M sections, such as inpatient, skilled nursing facility, or emergency-department-based E/M codes. Changes to those codes will be addressed in future guidelines.

Removal of History and Exam as Required Elements, Medical Decision-Making, and Time as Basis for Code Selection

In the new guidelines, “history” and “exam” are removed as required elements for selecting the level of service. The new guidelines specifically state the following:

Office or other outpatient services include a medically appropriate history and/or physical examination, when performed. The nature and extent of the history and/or physical examination is determined by the treating physician or other qualified health care professional reporting the service. . . The extent of history and physical examination is not an element in selection of office or other outpatient services.

Once these changes take effect, from a coding perspective, auditors should not require history or exam in their assessment of the service. However, payers may deny coverage if the history or exam documented is not “medically appropriate” or in support of “medical necessity.” The AMA’s intent is to allow the full medical record to support the service without the requirement of redocumenting history and irrelevant exam elements in the day’s note.

Medical decision-making or time will now be used as the basis for code selection. These two elements have been redefined in the new guidelines. Applying the 1995 or 1997 documentation guidelines for the new codes would not be appropriate, as there will be some cases when the code selection would differ depending on which guidelines are applied, even though the AMA did not intend for the code level to change when the clinical circumstances are the same.

Bottom line: watch for auditors creating documentation requirements that are not mandated by the guidelines.

New Definitions

The new guidelines list definitions of relevant terms, including “Undiagnosed new problem” and “Drug therapy requiring intensive monitoring for toxicity.” These definitions may be different from common industry interpretations. Lack of understanding of the nuances considered in these definitions, and payer interpretations of the same, will cause additional audit risk and points of contention.

Data Review

Additionally, “data” remains a component of the medical decision-making. One area of concern is accounting for the “review of the result(s) of each unique test.” The guidelines state, for the segment overall, “[t]he amount and/or complexity of data to be reviewed and analyzed. This data includes medical records, tests, and/or other information that must be obtained, ordered, reviewed, and analyzed for the encounter. This includes information obtained from multiple sources or interprofessional communications that are not separately reported.”

The guidelines add, “When the physician or other qualified health care professional is reporting a separate CPT code that includes interpretation and/or report, the interpretation and/or report should not be counted in the medical decision-making when selecting a level of office or other outpatient service.”

Many providers are not aware of what is separately reported, nor are they aware of the specific terms in the CPT descriptions regarding “interpretation and report,” which relates to the professional documentation required by some diagnostic tests in order to be separately billed. There is concern that some providers and coders will account for all diagnostic reviews performed, rather than excluding those performed and billed separately, and will potentially code too high—more than can be defended upon audit.

New Prolonged Services Code

A new prolonged service code, 99417, will create additional confusion and debate regarding these changes. Described as 99XXX in the 2021 MPFS Proposed Rule, it will be used when the time range for the level 5 office visit indicated in the CPT manual (99205: 60-74 minutes and 99215: 40-54 minutes) is exceeded in 15-minute increments. It is important to note that CMS and CPT are already in conflict on the application of this code. In the 2021 MPFS Proposed Rule, CMS interprets the starting point for the 15-minute clock to be at the top of the time range, while CPT defines that point at the lower end of the range.

Visit Complexity Code

CMS believes that the E/M changes and increases in RVUs do not fully capture the services provided by some physicians in the management of certain patients’ conditions. It has created an HCPCS code GPC1X to address this:

Visit complexity inherent to E/M associated with medical care services that serve as the continuing focal point for all needed health care services and/or with medical care services that are part of ongoing care related to a patient’s single, serious, or complex chronic condition.

In the 2021 MPFS Proposed Rule, CMS requested comment to clarify when this code should be utilized and to determine if its utilization assumptions are accurate, indicating changes may be forthcoming in the 2021 MPFS Final Rule. As proposed, there are several considerations that impact compliance and reimbursement/compensation.

- The GPC1X should only be used with CPT codes 99202 through 99215 on Medicare claims, unless a payer specifically adopts the use of the code. Therefore, this code should only be applied to the Medicare portion of a practice’s or physician’s volume of services to forecast future compensation or revenue changes.

- CMS has indicated its interpretation of the use of the code in the 2021 MPFS Proposed Rule. Therefore, it would be wise to make an educated assumption for code use when projecting reimbursement and compensation changes in 2021. However, a review of the Final Rule for clarification would be necessary.

- Without further clarification, it is likely this code will be utilized excessively, so the industry should expect audits for overutilization in short order. If providers report the GPC1X with an office visit code each time they bill Medicare because their specialty represents the “focal point” of care coordination—such as Internal Medicine providers—as opposed to reporting the code based on patient-specific circumstances, they may be exposed to risk under the False Claims Act.

Industry Impact

E/M Documentation Changes Make Coding Easier, Auditing Harder

Love them or hate them, the current coding guidelines for the history and exam components of the E/M services are nothing if not concrete. They provide fairly detailed, objective standards that allow coding experts who are not clinicians to analyze and audit for compliance with the rules. The downside to this approach, from a physician’s point of view, is that the level of service the physician perceives as appropriate requires him or her to provide “extra” documentation, meaning documentation above and beyond that otherwise needed to effectively treat the patient. This sometimes has included repetitive information or “check the box” exercises that allowed a trained coder to confirm the service satisfied guidelines.

But under the new guidelines, there is more of a focus on the clinical status of the patient and complexity of the visit. This change may make the clinician’s job easier and auditing their work significantly harder. It is possible that the need for second-level clinician review will become the norm in routine auditing and pre-acquisition diligence exercises. The move to more subjective documentation standards also increases the likelihood that payer denials will be subject to higher-level reviews and appeals. When the clinical picture is lacking documentation clarity, neither party will be able to apply an objective standard and confirm whether the audit requirements were satisfied.

wRVU Changes’ Impact on Physician Compensation Models

The wRVU changes will likely have a significant impact on employed physician compensation models. These models in particular have been trending in favor of wRVU methodologies for many years because they are a measure of physician effort—an explicitly permitted approach under both the federal Anti-Kickback Statute and Physician Self-Referral Law (aka the Stark Law). Increases to the amount of wRVUs generated from an E/M service that required the same amount of provider effort as before could have drastic and unpredictable impacts on individual physician compensation. Many compensation models were developed based on assumptions regarding historic productivity levels. If some of those codes suddenly generate more or less wRVUs, but the underlying assumptions and per wRVU rates have not been adjusted, there will certainly be “winners” and “losers,” perhaps to the point that their total compensation amounts would no longer be considered fair market value.

It seems likely that this shift in wRVUs will require a significant level of re-valuing existing physician arrangements. And these re-valuation exercises may prove extremely difficult during the transition period, given the significance of the effort necessary to do so, and that much of the existing benchmark data will not yet reflect these changes. To the extent employers are not able or willing to execute on new valuations before the changes go into effect in the next few months, particularly to the extent that the net impact of the new wRVU rates is hard to predict, there is a risk that it might be interpreted by auditors or enforcement agencies as a failure to act. Finally, given regulatory restrictions on changing compensation methodology within one year of contract execution, some systems or employers will find themselves caught between competing regulatory mandates—that they set their compensation in advance and that they take steps to ensure it is consistent with fair market value.

Conclusion

The 2021 E/M coding changes are poised to make a big impact in the coming year. As seen with COVID audit responses, it is not likely that providers will find much leniency in the implementation of these new coding rules. Health care organizations, and the attorneys advising them, should prepare now for future audits by fully understanding the new guidelines as well as the reimbursement changes once they are finalized in the 2021 MPFS.

[1] CY2018 Medicare Physician Fee Schedule, Final Rule

[2] Relative Value Scale

[3] CPT® Evaluation and Management (E/M) Office or Other Outpatient (99202-99215) and Prolonged Services 99354, 99355, 99356, 99XXX) Code and Guideline Changes, AMA 2019, effective Jan. 1, 2021.